What are Foreign Trade Zones?

Foreign-Trade Zones (FTZ) are secure areas under U.S. Customs and Border Protection (CBP) supervision that are considered outside CBP territory and therefore outside the U.S. commerce. Foreign Trade Zones are located in or near CBP ports of entry that are authorized by the Foreign Trade Zones Board under the Foreign Trade Zones Act of 1934.

Foreign and domestic merchandise may be moved into zones for operations, not otherwise prohibited by law, including storage, exhibition, assembly, manufacturing, and processing. Foreign Trade Zone sites are subject to the laws and regulations of the United States as well as those of the states and communities in which they are located. Under FTZ procedures, the usual formal CBP entry procedures and payments of duties are not required on the entry of foreign merchandise unless and until that merchandise enters CBP territory for domestic consumption.

The Advantages of Using a Foreign Trade Zone

The most common operation of Foreign Trade Zone activity is manufacturing or processing. For manufacturers who import merchandise for production, any duties or federal excise tax, are generally paid to Customs and Border Protection at the time the merchandise is imported. Utilizing FTZ procedures, any dutiable merchandise that enters a FTZ may not be subject to U.S. duty or excise tax until such time as the operator of the FTZ elects to enter the merchandise into the U.S. commerce.

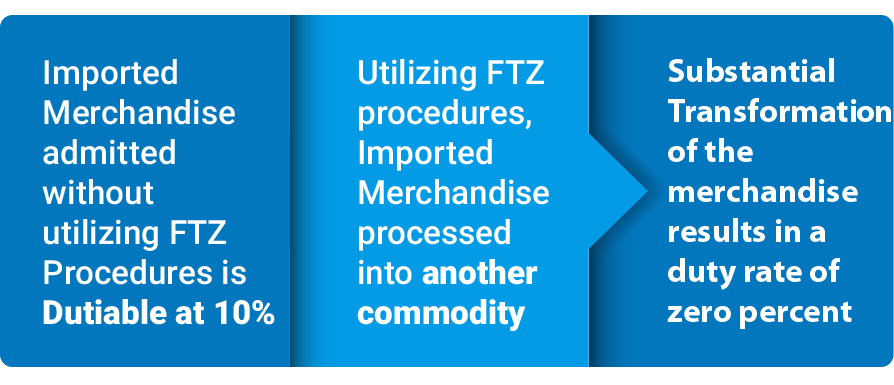

In the diagram below, company “A” establishes and implements FTZ procedures. Prior to using FTZ procedures company “A” was importing $500,000 worth of merchandise every month and paying a duty rate of 10 %. As a result of processing under FTZ procedures, the final product becomes something different and is classified with a resulting duty rate of 0 %. Company “A” has thus saved $300, 00.00/year.

Example: How you can save money with a Foreign Trade Zone

How Do I Establish a Foreign Trade Zone?

Establishing a Foreign Trade Zone consists of three criteria:

- A Feasibility Study must be executed

- An FTZ application must be submitted to the FTZ Board

- An Activation Application must be submitted to Customs & Border Protection

A Few of The Manufacturers That Have Established Foreign Trade Zones